Elliott Wave Theory is a powerful market analysis tool that helps traders understand price movements based on crowd psychology. It was developed by Ralph Nelson Elliott in the 1930s and is widely used in forex, stocks, and crypto trading.

The Core Idea

Markets move in repetitive wave patterns that reflect human psychology—alternating between bullish (impulsive) and bearish (corrective) phases.

Motive waves have a subdivision of five waves and always move in the same direction as the trend of one larger degree. The most poplar and common motive wave is an Impulse. Impulsive waves have five (5) subdivisions which are always labelled 1, 2, 3, 4, 5 Impulsive patterns occur in waves 1,3,5 and in corrective waves A and C. The sub-waves (1,3 and 5) of an impulsive wave are themselves motive.

Rules and Guidelines

- Wave 3 can never be the shortest impulse wave – among Waves 1,3 and

- Wave 2 cannot retrace to a new price low of wave 1

- Wave 4 never ends in the price area of Wave 1 except in diagonal

- Impulsive waves have five (5) subdivision and Waves 1, 3 and 5 are themselves impulse

- As a guideline, Wave three (3) shows the greatest thrust, except when Wave five (5) is an extended

- As a guideline, the internal wave structures of corrective Waves 2 and 4 should be different which is termed as

As a guideline Waves 2 and 4 often bounce off Fibonacci retracement levels

Corrective waves are composed of a three (3) waves structure that retraces a percentage of a preceding move.

It trends in the opposite direction as the wave of one larger degree.

They are always labelled with letters. Waves 2, 4 and B are corrective waves.

Examples of Corrective Waves are:

- Zigzags

- Flats

- Triangles

- Double Three

- Triple Three

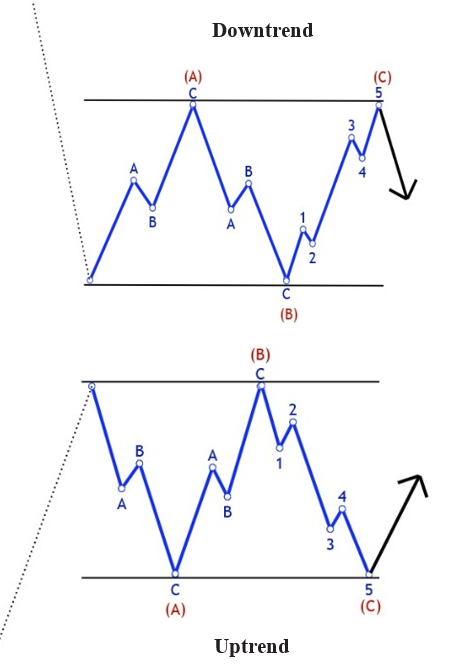

A zigzag is a three-wave corrective pattern that has two impulsive waves of a lower degree. Mostly, the pattern typically is a counter-trend formation and moves against the main trend. Its inception is mostly a sharp reversal and can be mistaken for impulse because of the momentum it shows

Rules and Guidelines

- It is composed of 3 waves.

- Waves A and C are impulsive waves, while Wave B is corrective.

- The sub-wave sequence is 5-3-5.

- The end of Wave B is noticeably lower than the origin of Wave A.

- Wave C must go beyond the end of Wave A.

- Wave C and Wave A are probably equal.

Flats are a very common form of corrective patterns, which generally shows a sideways direction. A flat correction differs from a zigzag in that the sub- wave sequence is 3-3-5. Flats corrections usually retrace less of preceding impulse waves than do zigzags. It occurs most in B waves, though also quite common in Waves 2 and 4.

Rules and Guidelines

- It is a three-wave (3) structure.

- Wave C is an impulsive wave, while Waves A and B are corrective.

- Wave A's move is reversed by Wave B and ends near the origin of Wave A.

- Wave C shouldn't retrace beyond the end of Wave A.

- Wave C and Wave A are probably equal.

Triangles are overlapping five wave affairs that subdivide 3-3-3-3-3. They appear to reflect a balance of forces, causing a sideways movement that is usually associated with decreasing volume and vitality

Rules and Guidelines

- It is a five-wave structure labeled a, b, c, d, e.

- Waves D and A do overlap.

- Wave D cannot move farther than the origin of Wave C.

- Wave C cannot be the shortest wave.

- Sub-waves of the triangle have corrective wave structures.

- Wave A is the longest, while Wave E is the shortest.

- As a guideline, the sub-wave structures should alternate.