Elliott Wave analysis of the EUR/GBP market on the 4-hour timeframe.

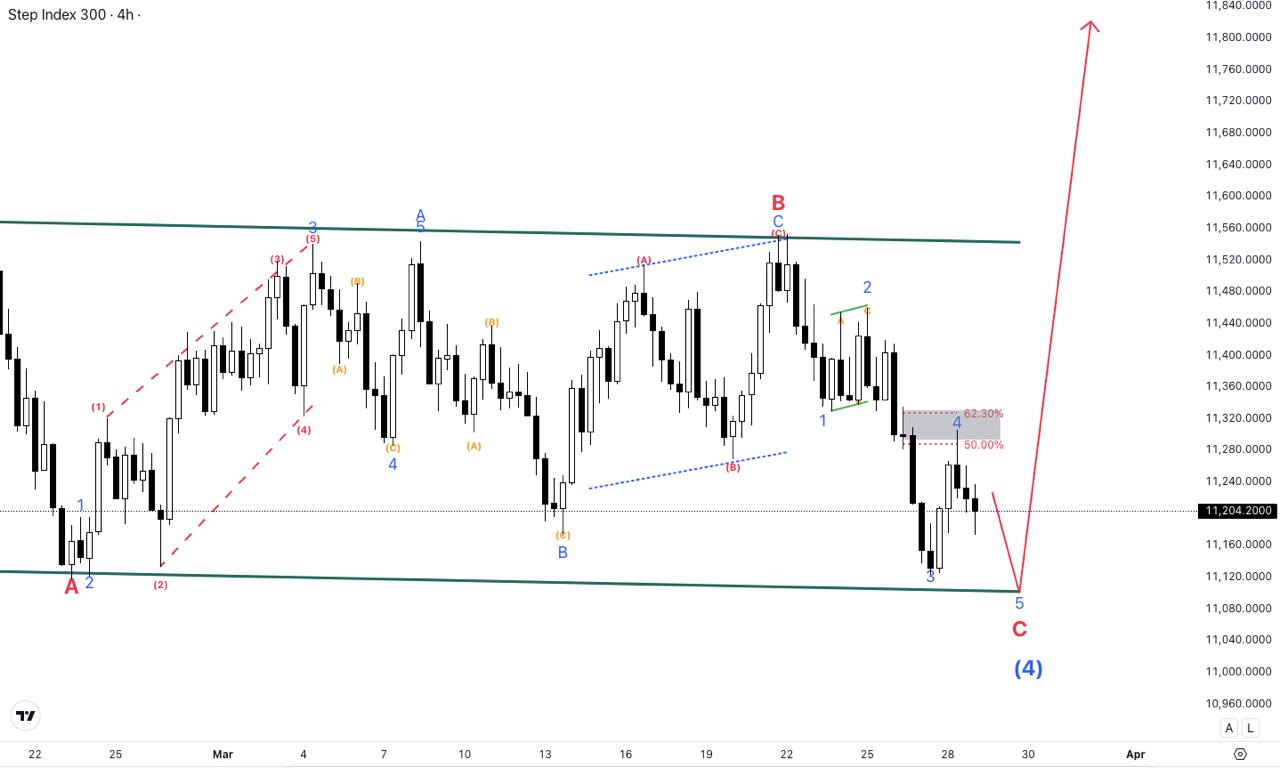

Wave B marks the end of a corrective phase, where the price moved downward in a corrective wave structure.

Impulse move upwards: After reaching Wave B, the price started a strong upward move, potentially confirming the beginning of Wave C.

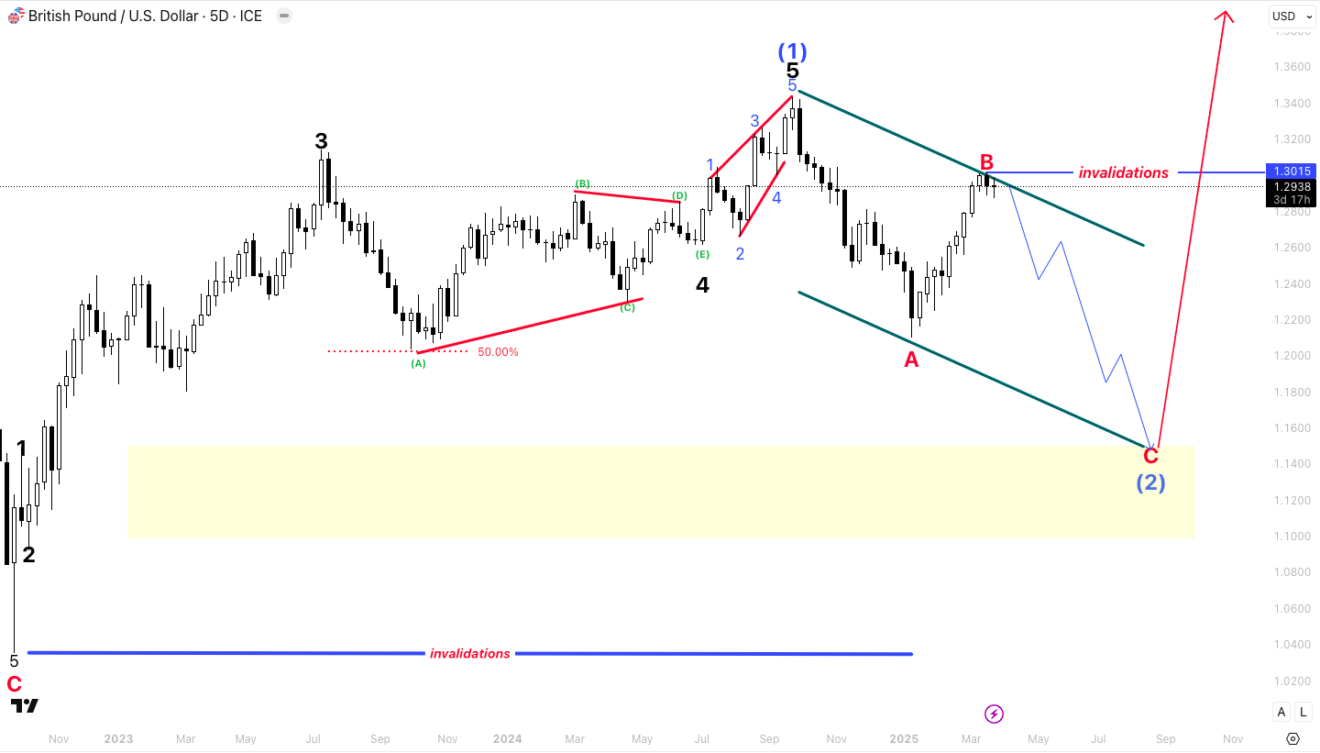

BTCUSD 1W UPDATE

📌 Bitcoin (BTC/USD) Weekly Elliott Wave Analysis

Current Trend: Bitcoin is in Wave 4 correction, testing key support on the ascending trendline.

Next Move: If support holds, BTC could rally into Wave 5, targeting 120K – 130K.

Post-Wave 5: A major correction could follow, potentially dropping BTC to 40K – 50K.

Key Levels:

Support: ~80K – 86K (must hold for bullish continuation).

Resistance: ~120K – 130K (potential Wave 5 target).

Trading Plan:

✅ Look for bullish confirmation near support for a long setup.

❌ Break below support could invalidate the bullish structure.

- 1

- 2